Decree postpones payment of state tax installments until 30/05

The decision to postpone the collection dates occurred due to the period of instability faced on the Sefa Services Portal, caused by the massive use of bots

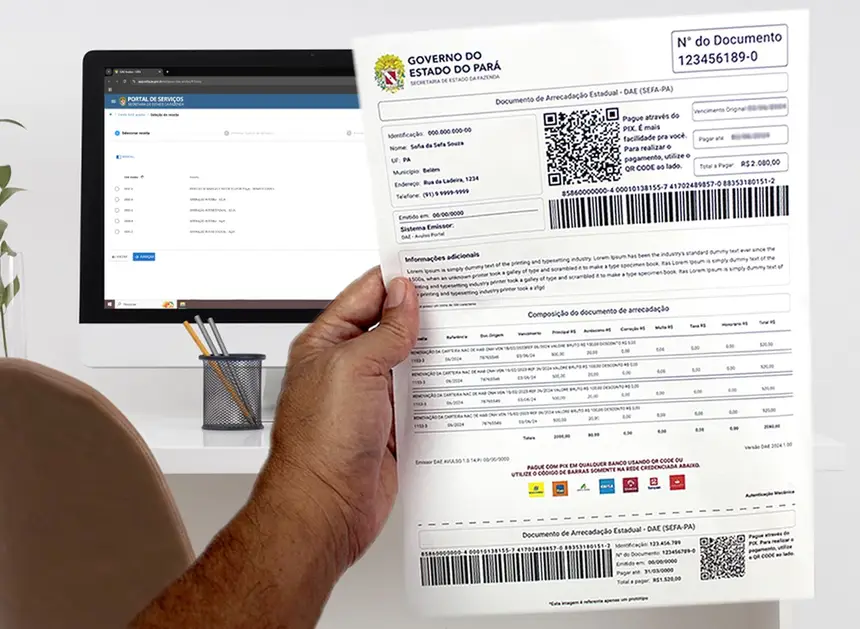

The State Government published, in the Official State Gazette (DOE) this Wednesday (28), decree number 4,689, postponing the due date of the April 2025 installment of the installments related to state taxes.

The due date of the April 2025 installment of ongoing installments is postponed, exceptionally this month, until 30/05/2025.

The postponed installments are provided for in Decrees 2,057/2018 (installments of tax and non-tax credit in general) and decrees no. 1,944/2017, 2,103/2021, and 4,296/2024, respectively from the Fiscal Regularization Program (Prorefis) of the year 2017; of the year 2021 and of the year 2024.

This measure reinforces decree 4,676/25, of May 22, in which the State Government of Pará regulated the postponement of the collection of the Tax on Transactions Related to the Circulation of Goods and the Provision of Interstate and Intermunicipal Transport Services and Communication (ICMS) exceptionally, until May 30, regarding the generating facts that occurred in April 2025.

The deadline for sending the Digital Tax Bookkeeping (EFD) file for the reference of April 2025 has also been extended until 30/05.

Services - The decision to postpone the collection dates occurred due to the period of instability faced on the Services Portal of the State Department of Finance (Sefa), caused by accesses from bots that perform mass requests for the file download service, overloading the traffic and paralyzing the other services available, both for servers and for taxpayers in general.

The Portal services have been restored. The download of DF-e (XML) files is temporarily suspended during the daytime. Access is allowed only between 6 PM and 6 AM, in order to avoid instability and the collapse of other available services.

For questions, contact the Sefa call center, by message or call to 0800.725.5533, from Monday to Friday, from 8 AM to 6 PM. The call is free. Or via chat on the Sefa website.