Pará Incentive Policy Commission approves two projects for renewal of tax benefits

Currently, 210 companies have incentives in the State of Pará, distributed across more than 50 Pará municipalities.

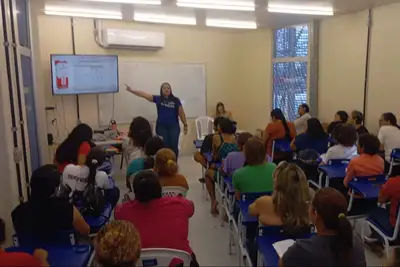

The Pará State Socioeconomic Development Incentive Policy Commission held its second extraordinary meeting of 2025 on this Friday (30). On the agenda, the renewal of tax benefits for two business projects was approved, focusing on job creation and sustainable industrial growth.

The plenary was chaired by the acting secretary of the Secretariat of Economic Development, Mining and Energy (Sedeme), Juliana Vaz Maestri, who opened the proceedings by thanking the members for their presence, both in person and remotely. She presented the two projects up for vote and emphasized the importance of tax incentives as a strategic tool to boost the Pará economy.

Also participating in the meeting was the operational secretary of Tax Incentives (Secop), Ângelo Castro, who reminded that the projects had been previously presented but returned to the agenda due to requests for review from commission members. During his presentation, Castro provided technical analyses prepared by the Project Evaluation and Analysis Group (Gaap) and the Technical Chamber (CT), responsible for assessing the feasibility and impacts of the projects.

Castro reinforced the need for the benefiting companies to comply with the legal guidelines of the incentive policy, in addition to advocating for the updating of current legislation to ensure greater efficiency and alignment with the principles of sustainable development.

Among the approved projects is that of Grupo Alubar Metais e Cabos S/A, based in Barcarena (Tocantins Integration Region). The company specializes in electrical cable solutions, rebar, and aluminum alloys, employs 735 employees, and is considered the largest manufacturer of electrical cables in Latin America and the leading producer of aluminum rebar on the continent.

The other beneficiary was Floraplac MDF Ltda, located in Paragominas (Capim Integration Region). The company operates in the production of MDF from reforested wood, promoting a sustainable production process. With the renewal of the incentive, the company projects a 26.5% increase in the number of jobs, rising from 271 to 343 in five years.

After the commission's approval, the next step will be the publication of the resolution that formalizes the benefits. The tax incentives can vary from 50% to 90%, reaching up to 95% for activities considered strategic. The duration of the benefits is from 7 to 15 years, with the possibility of extension for an additional 15 years.

Currently, 210 companies receive tax incentives in the state, distributed across more than 50 municipalities, according to data from Secop, an agency linked to Sedeme through Decree No. 1.277/2015. The secretariat is responsible for managing the incentive policy, through joint action with the Technical Chamber, Gaap, and the Group for Monitoring Incentivized Projects (Gapi).

The Commission is composed of representatives from the state secretariats of Science, Technology and Higher, Professional and Technological Education (Sectet); Finance (Sefa); Agricultural Development and Fisheries (Sedap); Environment and Sustainability (Semas); and Planning and Administration (Seplad), as well as the Pará Economic Development Company (Codec), Banpará, and the State Attorney General's Office (PGE).