Pará celebrates 25 years of Tax Education with a focus on social participation

The Program and the Group were created with the mission of contributing to citizens' awareness of the social importance of taxes and their application, for the construction of a free, fair, and supportive society.

Tax Education is a continuous process that must involve the entire society, as it aims to stimulate the exercise of citizenship. This definition comes from the Secretary of Finance of Pará, René Sousa Júnior, during the ceremony celebrating the 25th anniversary of the establishment of the State Program and the State Group of Tax Education in Pará, held this Wednesday (11).

"It must be a public policy, as Tax Education strengthens citizenship and encourages citizens to monitor the use of public resources, increases transparency, and helps people understand public services," emphasized the head of Sefa. He thanked the dedication of the civil servants and the support and partnership with other institutions that develop the Program in Pará.

The Program and the Group were created through decree No. 4.014/2000, with the mission of contributing to citizens' awareness of the social importance of taxes and their application, for the construction of a free, fair, and supportive society.

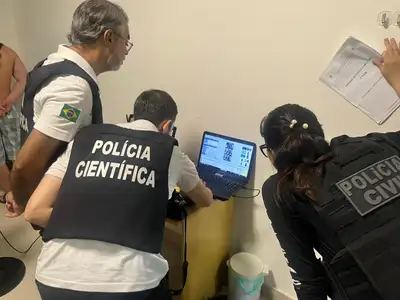

The event brought together public servants, disseminators of Tax Education, and partner institutions in city actions, at the Sagres hotel in Belém, and was attended by Regina Hirose, attorney of the National Treasury, who spoke about "Tax Education and Conscious Consumption," in addition to the launch of the e-book on the actions and awarded projects of Tax Education in Pará. Justice attorney Joana Chagas Coutinho represented the Public Ministry of Pará at the event.

For the president of the Court of Accounts of the State of Pará (TCE-PA), counselor Fernando de Castro Ribeiro, the public management of the State has undergone many changes in recent years. The public treasury, in particular, he explains, has undergone improvements in its technical framework, thus restoring the credibility of the State's tax machinery. According to him, there has been a change in the Government's posture not to allow political interference in the revenue-collecting machinery, which, along with the good results of its own revenue, ensured a positive outcome in the performance of the State's tax authority.

Counselor Antônio José Guimarães, from the Court of Accounts of the Municipalities, highlighted the partnership actions that the Courts – TCM and TCE – have carried out in the State, with the participation of civil servants from the Secretary of Finance and other public bodies, providing information to municipal managers.

The superintendent of the 2nd Fiscal Region of the Federal Revenue of Brazil, Altair Sampaio, recalled her journey as a disseminator of Tax Education and reiterated that the RFB supports and encourages actions of fiscal citizenship. "My story is intertwined with the history of Tax Education in Pará. I am a different person since I got to know the Program," she stated.

Partnership Actions - The coordinator of the State Group of Tax Education, Zilda Benjamim, highlighted, among the activities being carried out this year, the Conversation Circles "Let's Talk About Citizenship?", a project in partnership with the Peace Factories.

"Public servants lead the conversation on the topic, promoting reflections on the role of each citizen in combating corruption. This way, the audience can analyze, debate, and propose solutions, exercising critical thinking and a sense of collective responsibility."

The municipal secretary of Finance of Santarém, Josilene Lira Pinto, was present at the event representing the Municipal Group of Tax Education of that municipality. She recalled the group's journey and its partnership with the State Group, in training actions and the development of projects in public schools, which resulted in national recognition: the schools in Santarém received eight awards in various editions of the National Tax Education Award, held annually by Febrafite (National Association of State Tax Auditors).

Members - The State Group of Tax Education in Pará includes public servants from the State Secretary of Finance (Sefa); the State Secretary of Education (Seduc); the Superintendency of the Federal Revenue of Brazil - 2nd Fiscal Region and the Court of Accounts of the Municipalities of the State of Pará (TCMPA).