In Marabá, Sefa shows growth in the transfers of the ICMS share

The amounts increased for all municipalities, at different percentages, due to the growth in revenue collection in the State

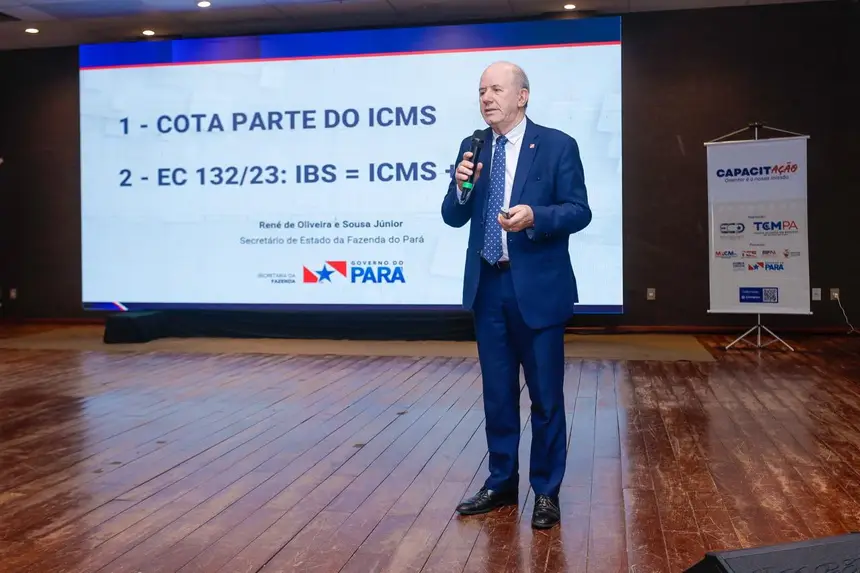

The Secretary of Finance of Pará, René Sousa Júnior, was in Marabá on Monday, the 23rd, participating in the training event of the Court of Accounts of Municipalities (TCM) in that city, and took the opportunity to talk with taxpayers and accountants at the Commercial and Industrial Association of Marabá. He presented a summary of the changes that will come with the tax reform on consumption and commented on the growth of constitutional transfers to municipalities.

The secretary addressed the challenges of the consumption reform, which combined state and municipal taxes and created the Tax on Goods and Services (IBS) that will be managed by a Management Committee, which includes representatives from the federative entities and Brazilian municipalities. The changes will require a significant investment in technology, training of civil servants, and adaptation of state and municipal tax administrations in governance matters.

Regarding the share of the Tax on Circulation of Goods and Services (ICMS), which is transferred to the 144 municipalities in Pará, the secretary presented the amounts transferred by the State from 2018 to 2024. For the 19 municipalities in the southeastern region of the State - Bom Jesus Tocantins; Brejo Grande do Araguaia; Breu Branco; Canaã dos Carajás; Curionópolis; Eldorado Do Carajás; Goianésia do Pará; Itupiranga; Jacundá; Marabá; Nova Ipixuna; Novo Repartimento; Palestina do Pará; Parauapebas; Piçarra; São Domingos do Araguaia; São Geraldo do Araguaia; São João do Araguaia and Tucuruí - R$ 782,790,510.61 was transferred in 2018; in 2024, the transfer grew to R$ 2,231,966,722.28.

The amounts increased for all municipalities, at different percentages, due to the growth in revenue collection in the State.

In the municipality of Palestina do Pará, the growth of the amounts transferred between 2018 and 2024 was 211.55%, rising from R$3,548,213.61 to R$ 11,054,497.11; in Parauapebas, the growth was 173.26%, increasing from R$ 310,605,160.81 to R$ 848,770,146.93. For the municipality of Marabá, the transfer increased from R$167,584,858.31 in 2018 to R$ 277,866,244.85 in 2024, a growth of 65.81%.

In Canaã dos Carajás, the transfers grew more than 10 times between 2018 and 2024, rising from R$ 47,218,535.00 to R$ 654,789,207.91, respectively.

The growth of ICMS revenues increases the transfer of the share to municipal administrations, thereby helping to improve the public works and services available to the population of Pará.

"The growth of state revenue strengthens municipal economies. According to the legislation, 25% of the total ICMS revenue belongs to the municipalities, and the state government has been religiously transferring the amounts due. Even with the variations in the indices of the share allocated to municipalities, the growth of the State's revenue positively impacts the finances of municipal entities. And that is why it is so important for the State and municipalities to work together, especially starting next year, as we will begin the transition to the implementation of the Tax on Goods and Services (IBS)," said the Secretary of Sefa.