Sefa simplifies the Interstate Entry Declaration for Simples Nacional

The Secretary of Finance of Pará emphasizes that the new way of filling out the document, which is mandatory, facilitates the tax regularization of taxpayers

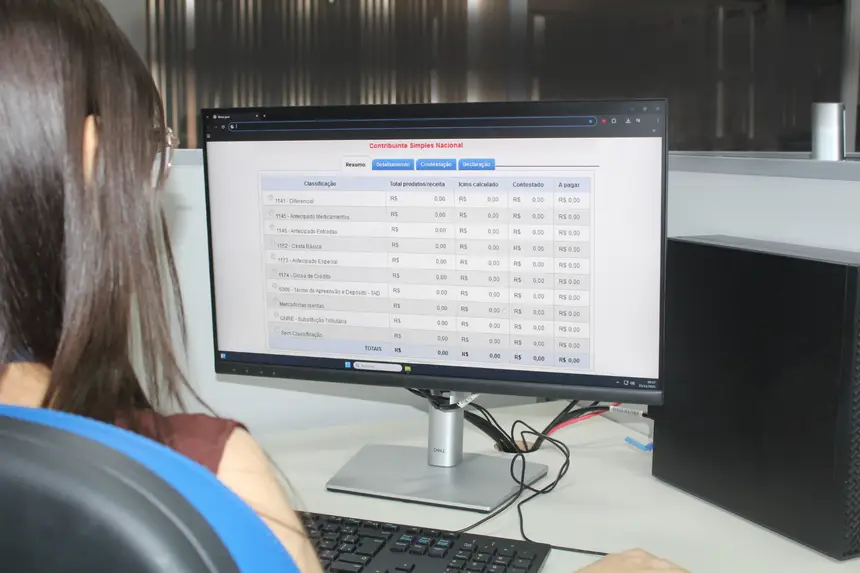

The State Secretary of Finance of Pará (Sefa) presented to taxpayers the new Interstate Entry Declaration (DEI) for businesses opting for Simples Nacional. With this, since the 21st of this month, it has become easier for entrepreneurs to fill out the declaration and remain compliant with the state tax authority.

The filling out of the DEI is mandatory for those opting for Simples, ICMS taxpayers, in the months when they purchase goods from other Federative Units. The document is available on the Sefa service portal online.

"The new DEI has been simplified in response to requests from taxpayers and accountants. It is another way for the tax authority to facilitate the tax regularization of taxpayers," informs the Secretary of Finance, René Sousa Júnior.

The stage of contesting values has been removed from the DEI. "When there is a discrepancy between the values presented by Sefa's calculations and those calculated by the taxpayer, it is enough to inform the value that they consider correct, without the need for individual contestation of each item. All information will be evaluated by Sefa's inspection," explains the coordinator of micro and small enterprises, Márcio Carvalho.

The benefits of the change are the time savings in submitting the declaration, which comes

pre-filled, but accepts changes to the values before submission; greater ease of self-regulation by the entrepreneur and the possibility of installment payments of debts after the DEI submission.

The entrepreneur can find the DEI on the Sefa Service Portal at: Service Portal; Anticipated ICMS, in the grouping "ICMS Anticipation". The user must authenticate in the system.

Sefa informs that in case of doubts, the interested party should contact the call center Sefa 0800.725.5533, by message or call, from 8 am to 6 pm, Monday to Friday; or chat on the website www.sefa.pa.gov.br.