Institute of Pension Management Presents Results of the Investment Policy

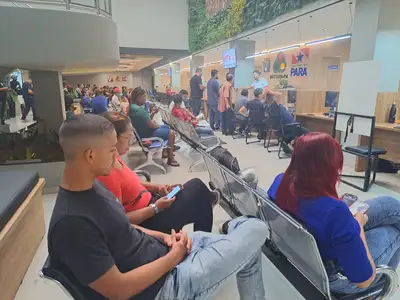

Prioritizing transparency, the hearing included the participation of representatives from class entities, counselors, civil servants, specialists from the pension sector, and civil society.

The Institute of Pension Management and Social Protection (Igepps) held a public hearing on Friday (5) to present and discuss strategic themes for the sustainability of the State's Own Social Security System (RPPS). The main focus of the event was the Investment Policy, Corporate Governance practices, and the Actuarial Assessment results of the Institute.

"The public hearing is very important as it ensures more transparency in the process, and the state government is increasingly bringing this sensitivity, showing the population what is being done," said Utan Lima, Statistics and Actuarial Technician at Igepps. The hearing included the participation of representatives from class entities, counselors, civil servants, specialists from the pension sector, and civil society.

“We are here to monitor and also to take and multiply this information to our agencies. It is of utmost importance to understand how this collection works and the distribution of these resources for the future, for us who are active and for those who are already retired. The importance is transparency, so that we can attest to the integrity of the expenses that the government has with the collections,” declared Marcos Moraes, a civil servant at Fasepa (Foundation for Socio-Educational Assistance of Pará).

Dialogue - The meeting aimed to ensure transparency in the management of pension resources, enhance dialogue with the insured, and promote the improvement of Igepps' institutional governance. "I am very happy that the Ombudsman is here to present our results, show how management is being done, where resources are being applied, and what our future proposal is. And besides being a space for accountability, the public hearing is an opportunity for society to express itself," informed the Institute's ombudsman, Mirian Rocha Kahwage.

During the presentation, the guidelines of the Annual Investment Policy were detailed, which establishes the parameters and criteria for the application of the resources of the Pension Fund, always in accordance with the principles of safety, profitability, liquidity, and solvency.

"It is essential that we take care to report to the civil servant, both active and inactive, because every pension contribution that we collect in their paycheck reaches us, and we have to manage it to make the best possible financial application, so that it generates returns and brings more benefits to the society of Pará. This is fundamental. It is a moment of exchange with our insured, which is essential for us to achieve transparency in Igepps' actions," said Henrique Mascarenhas, Investment Analyst and Coordinator of the Investment Management Unit.

Advances in the Corporate Governance structure adopted by the Institute were also presented. "Building a fairer, more efficient, and safer pension system requires dialogue, responsibility, and commitment. This public hearing is a valuable opportunity for the state government to advance on this path," stated the president of Igepps, Washington Albuquerque.

Approval - The holding of the hearing with the presentation of pension data was approved by participating civil servants and leaders. “I found it very relevant for us to understand where our money is being invested, how it is being used, and the return it is bringing to us, civil servants, and to society,” said Glória Soares, a civil servant at Fasepa.

“We presented the report of activities, process analysis, and progress on the rigidity of the benefits granting process. The result was very good,” assured the director of Pension at Igepps, Marcos Antônio Souza.